features

Growth curve

Deloitte's Karsten Hollasch reveals the most profitable fitness operators and countries with the most growth potential in Europe

While some people might associate the number 80 million with the population of Germany or the annual earnings of football star Cristiano Ronaldo, the European health and fitness association – EuropeActive – adopted the figure in 2014 to set a goal for the industry to attain 80 million members by 2025.

Three years later, the industry remains on track to reach this target, as total membership in the EU, Norway, Russia, Switzerland and Turkey rose by 4.4 per cent to 56.4 million at the end of 2016, according to the European Health & Fitness Market Report 2017 – produced by Deloitte in partnership with EuropeActive.

Global domination

Europe continues to be the world’s largest health and fitness market, with total revenues of €26.3bn in 2016, ahead of the US at €23.3bn in 2015, according to the IHRSA Global Report. Market size increased by 3.1 per cent in 2016 over 2015 at constant foreign currency exchange rates, with Switzerland at +5.8 per cent, Germany +4.6 per cent, Finland +4.0 per cent, Sweden +3.9 per cent and Turkey at +3.4 per cent, showing the highest revenue growth rates.

At actual foreign currency exchange rates, year-on-year growth in euros amounted to -0.5 per cent due to disruptions in exchange rate effects, most notably in the UK (-11.1 per cent), Turkey (-9.9 per cent) and Russia (-9.0 per cent), for well-documented reasons.

Low cost impact

As in 2015, the low cost segment was again one of the fastest growing segments in 2016, resulting in a decrease in average monthly membership fees in the European health and fitness market of 1.3 per cent at constant foreign currency exchange rates.

The more mature Northern and Western European markets also continue to see an increasing number of boutique fitness clubs opening.

Top operators

Karsten Hollasch, partner at Deloitte and head of Deloitte’s German Sports Business Group, says the major operators continue to be the drivers of growth: “The 30 largest operators had more than 12.7 million members at the end of 2016 – an increase of 15.5 per cent over the previous year’s top 30.

“While low cost operators continue to generate the highest organic growth” he continues, “premium and upper mid-market operators like Migros Group, Nuffield Health and DW Sports have made major acquisitions. This underlines not only continued market consolidation, but also increasing polarisation between the low cost sector on one side and boutique and premium operators on the other.”

The leading European operator in terms of membership remains German low cost chain McFIT Group, with an estimated 1.5 million members – an increase of 130,000 members on the previous year.

While the total number of McFIT-branded clubs increased by four from 237 to 241, the group also operated 14 clubs under the High5 brand and introduced the new John Reed brand in 2016, which had grown to six clubs at the end of that year.

John Reed follows the slogan ‘Not your average gym’ and combines elements of a classic McFIT gym with unconventional interior design and a strong focus on music, with monthly membership fees of €20 to €35. McFIT expanded the new concept further across Europe in 2017 and opened its first site in Budapest, Hungary.

Ranking second is the Netherlands-based, low cost chain Basic-Fit, which has 1.21 million members. Basic-Fit generated the highest organic membership growth of all operators in 2016, with 254,000 more members joining up. British low cost operator Pure Gym ranks third and increased its membership by 150,000 to a huge 820,000 in 2016. On the funding front, Pure Gym had to call off a planned IPO due to unfavourable capital market conditions in 2016, while Basic-Fit made an IPO at Euronext Amsterdam in June 2016, placing 26.7 million shares.

Growth by acquisition

A number of premium and upper mid-market operators completed major buyouts in 2016. In January 2016, Swiss retailer Migros Group took over full ownership of INLINE GmbH, the parent company of the German-based fitness franchise INJOY. The addition of INJOY, combined with the further expansion of its Swiss core business, led to an increase in membership for Migros from 256,000 to an estimated 451,000. This put the company eighth in the European ranking in terms of membership numbers.

In June 2016, Nuffield Health announced the acquisition of 35 clubs from Virgin Active. With 322,000 members – an increase of 109,000 over the previous year – Nuffield Health ranked as the largest not-for-profit operator in the UK at the end of 2016 as a result. In addition, British mid-market brand DW Sports executed one of the largest transactions in 2016, with the acquisition of Fitness First UK from its owners Oaktree Capital and Marathon Asset Management. The finalised deal included 62 clubs, of which 58 remained with DW Sports at the end of 2016, increasing DW’s total membership to 375,000 (+127,000).

Revenue leader

Despite the sale of 35 clubs to Nuffield Health and the negative exchange rate impact of trading in Sterling and Euros, Virgin Active retained its leading position in the European revenue ranking, with income of €499m in 2016. At the end of 2016, Virgin Active had 60 clubs in the UK, 33 in Italy, eight in Spain and four in Portugal, making a total of 115.

Second in Europe in terms of revenues is UK-based operator David Lloyd Leisure at €442m, followed by the Migros Group at €366m and Scandinavian market leader Health & Fitness Nordic at €337m. Due to its acquisitions, Nuffield Health solidified its spot at sixth place in revenue ranking at €261m, while DW Sports moved into ninth place with €188m and Russian-based premium operator Russian Fitness Group rounded out the group at €157m.

While premium operators continue to hold the leading positions in terms of revenues due to their higher membership fees and secondary revenues, the European top 10 by revenue includes three low cost operators: McFIT (€327m), Basic-Fit (€259m) and Pure Gym (€196m); despite reporting average annual revenues per member of less than €240. Overall, the top 10 operators boosted their revenues by 19.8 per cent (constant foreign currency exchange rate) and 12.2 per cent (euros) in 2016, underlining the greater market consolidation trend.

Holding its own

Health and fitness club operators remained attractive for investors in 2016 and while the number of deals decreased slightly, from 19 transactions each in 2014 and 2015 to 17 transactions in 2016, this number can be considered positive against the background of market events, according to Hollasch: “Despite market uncertainty in the UK following the Brexit vote in June 2016, the number of mergers and acquisitions remained at a high level in 2016,” he says.

“This underlines the continued attractiveness of the health and fitness sector for both strategic and financial investors and has resulted in significant M&A activity in the first few months of 2017.”

Activity was also strong on the market’s supply side, as shown by Life Fitness’ acquisition of Cybex in January 2016. Overall, it was another year of strong growth for the global commercial fitness equipment industry, which has an estimated market size of €2.76bn.

The six leading B2B fitness equipment manufacturers, Core Health & Fitness, Johnson Health Tech, Life Fitness, Nautilus, Precor and Technogym – which together accounted for 79 per cent of the market in 2016 – achieved total net sales growth of 14.3 per cent in 2016. When excluding the effects of the acquisitions of Octane Fitness by Nautilus and Cybex by Life Fitness, year-on-year growth amounted to 5.4 per cent.

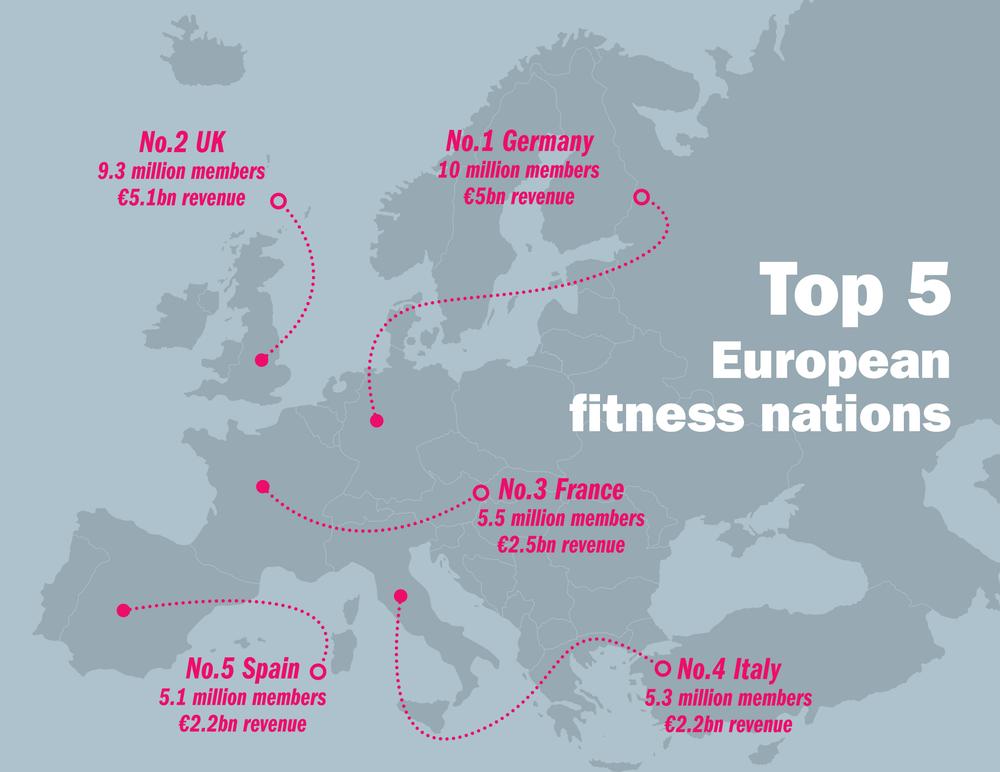

The top five

The German health and fitness market had a significant year in 2016, bursting through the threshold of 10 million total members and €5bn in revenues for the very first time.

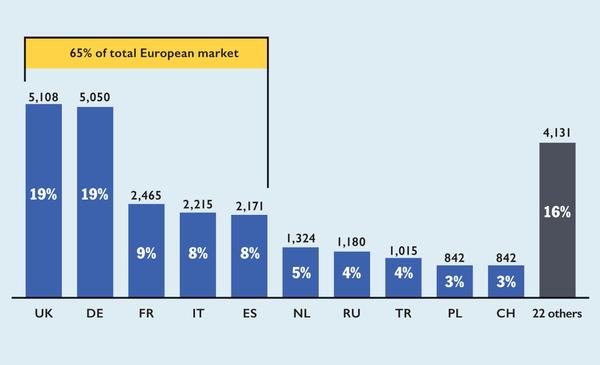

When combined, the top five European health and fitness nations – Germany, UK (9.3 million members/€5.1bn revenue), France (5.5 million members/€2.5bn revenue), Italy (5.3 million members/€2.2bn revenue) and Spain (5.1 million members/ €2.2bn revenue) – represent nearly two thirds of the entire European market in both membership numbers and revenues.

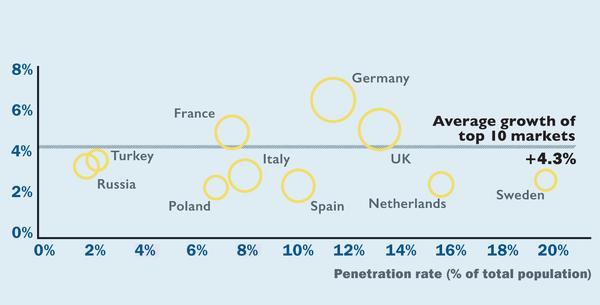

With penetration rates of 8-14 per cent, the top five offer growth potential and are expected to be major drivers towards the target of 80 million members by 2025.

High and low ratios

Sweden at 21.1 per cent, Norway at 19.2 per cent and the Netherlands at 16.7 per cent have the highest ratio of health and fitness club members to the total population.

At the other end of the scale, Turkey at 2.4 per cent and Russia at 2.0 per cent have relatively low penetration rates and, in combination with their large populations, show that there is potential for future growth.

Growth potential

Hollasch also expects new growth to come from unexpected places. “New concepts and business models are leading to structural changes in the fitness market,” he says.

“The definition of the industry as a purely bricks and mortar investment is over: existing fitness concepts are being augmented by digital offerings and new market participants are developing entirely new purely digital concepts, while an increasing number of health and fitness enthusiasts are engaging in outdoor activities, such as bootcamps, for instance.

“Further growth in the market will be driven by macro-trends such as increasing levels of disposable income and physical activity. But even more growth will come from improved fitness concepts that better meet customer preferences and offer transparency and flexibility.”

The continued growth of specialised boutique concepts like CrossFit are expanding the market and creating new ways to be physically active. While mobile apps, wearable tracking devices and online gyms have gained – and will continue to gain – popularity, digital technology is also a key element in the business model of fitness aggregators, providing flexible PAYG gym access through their websites and mobile apps.

In launching the report, Herman Rutgers, board member at EuropeActive and co-author, said he is very optimistic: “2016 was another year of strong growth in membership numbers and revenues. The operators in our survey also indicated they expect good growth for 2017 and beyond.

“This shows that our products and services remain highly attractive to consumers across Europe and makes us confident we’ll reach the industry goal of 80 million members by 2025.”

TOP EUROPEAN MARKETS BY REVENUE

TOP EUROPEAN MARKETS BY MEMBERSHIP GROWTH

About the authors

Karsten Hollasch

Partner at Deloitte and head of Deloitte’s German Sports Business Group

www2.deloitte.com

Herman Rutgers

EuropeActive board member and chief executive officer of Global Growth Partners

www.europeactive.eu